“A climate cash crunch” By Michelle Ma

“AI has sucked all the oxygen out of the room,” said Matt Eggers, a managing director at Prelude Ventures, which invests in climate startups. “It’s not like anything we’ve seen since perhaps mobile….”

Today’s newsletter looks at the stark downward trend in climate tech funding as generalist VCs are moving away right as the industry needs more capital to get off the ground. You can read and share a full version of this story on Bloomberg.com. For unlimited access to climate and energy news, please subscribe.

A climate cash crunch

By Michelle Ma

Generalist investors’ rush into buzzier artificial intelligence has added to funding woes for climate-tech startups at just about the worst time for an industry racing to combat the effects of climate change.

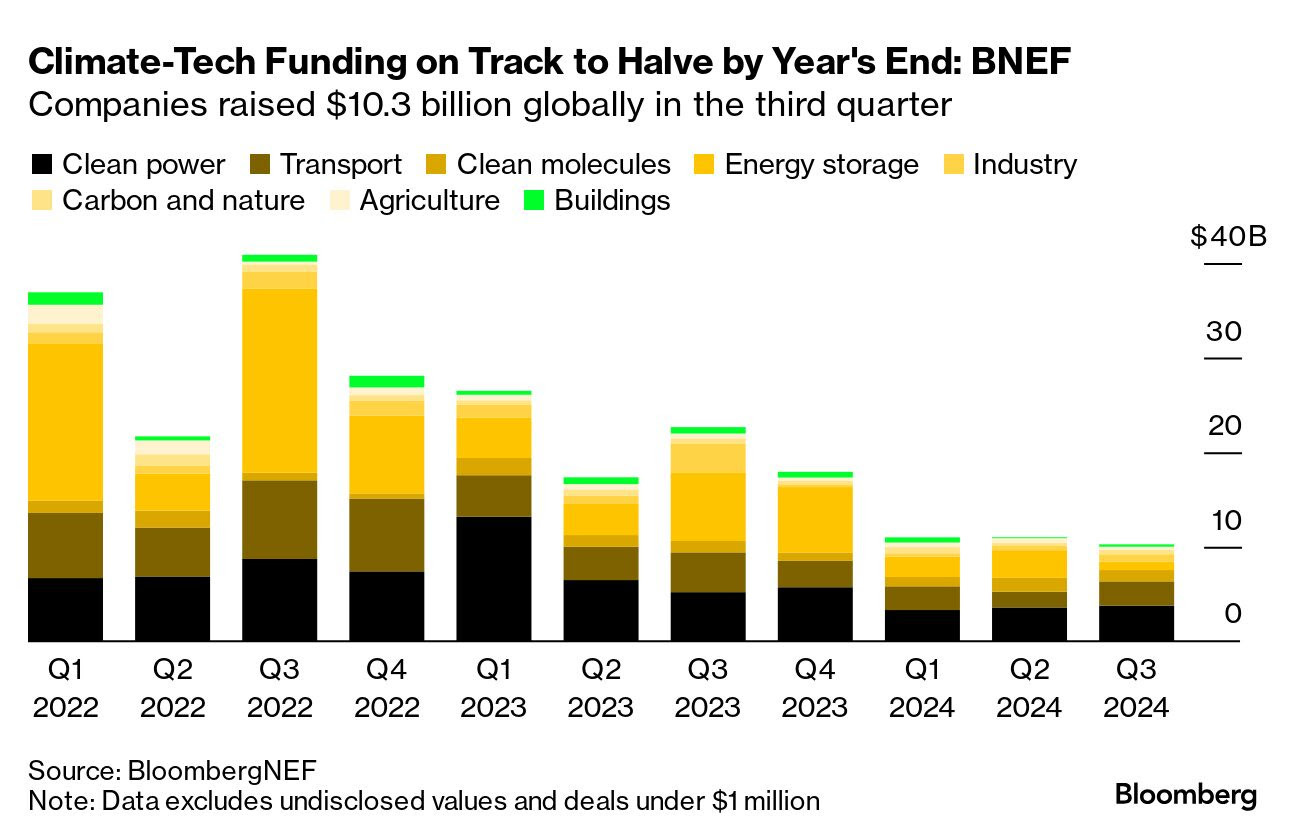

Globally, climate-tech companies raised roughly $10.3 billion in equity across public and private markets in the third quarter, putting full-year funding on track to fall about 50% this year, data from BloombergNEF show. Meanwhile, capital for AI has climbed, with startups in that space raising more than $21 billion in the quarter, Pitchbook estimates.

“AI has sucked all the oxygen out of the room,” said Matt Eggers, a managing director at Prelude Ventures, which invests in climate startups. “It’s not like anything we’ve seen since perhaps mobile in 2010.”

It’s not just competition from AI that’s impacting climate-tech funding, which began inching lower even before the generative AI frenzy in 2023. Still, it’s a contributing factor, and a slowdown in funding for climate tech at such a critical time for the nascent sector could have irreversible consequences.

The opportunity for limiting the catastrophic impacts of climate change was already shrinking, underscoring the need to speed up spending on novel climate technology. Now, with AI threatening to keep fossil fuels online for longer, there’s even less room for error.

Part of the reason some investors are stepping back is the fact that a lot of climate-tech startups are either already in or approaching the most capital-intensive, hardware-focused stages of development. Commercializing never-before-deployed technologies is expensive and risky, unless favorable policy support can help bring down costs and drive demand.

Scaling AI requires infrastructure buildout and capital investment, too, but it doesn’t necessarily require the same appetite for technological risk.

“We know how to build a data center,” said tech billionaire and OpenAI backer Vinod Khosla. The same cannot be said for some early-stage climate technologies like nuclear fusion, which remains years away from the market, and green hydrogen, still in the early stages of deployment — though both could see more interest as investors seek opportunities to meet the intense energy demands for AI.

Read the full story to find out what some of the remaining bright spots are for climate tech. Subscribe for even more energy transition and investing news.

Thank you for this article. This is the message I sent to Bloomberg Reporter Michelle Ma, based in Los Angeles, California.

Bloomberg Reporter Michelle Ma fails to report there is a technology that prevents air and water pollution while providing 24/7 reliable power for data centers. That technology is nuclear power. While fossil fuel interest lobbying and fossil fuel interest P.R. may attempt to shut down nuclear power, many data center owners are clamoring for additional safe, clean, cost-effective and reliable nuclear power. As an example, see the power purchase agreement between Microsoft and Constellation Energy (CEG) announced on September 20, 2024 https://tinyurl.com/Crane-Clean-Energy

I previously reported the substantial load growth forecast for Silicon Valley to 2030 by DCPP owner PG&E in their June 12, 2024 Investor Update. https://s1.q4cdn.com/880135780/files/doc_presentations/2024/June/Investor-Update-2024-Presentation_Final.pdf

CEG is still trading well above what it was trading at on September 19, 2024. Given the market fundamentals discussed in Reporter Michelle Ma's article, I believe the gains will persist. DISCLOSURE: Our family has a very small CEG position.