“Gas-Fired Power Back in Style, Driven by AI & Data Centers”, by Jim Willis

“If you’ve read MDN for any time, you’ve come across at least a few articles about gas-fired power. Nationwide, natural gas produces 43%of all electricity, the number one source of electric generation

Gas-Fired Power Back in Style, Driven by AI & Data Centers

ELECTRICAL GENERATION | INDUSTRYWIDE ISSUES | M&A

January 14, 2025

If you’ve read MDN for any time, you’ve come across at least a few articles about gas-fired power. Nationwide, natural gas produces 43.1% of all electricity, the number one source of electric generation (see this EIA page). Nuclear is number two, producing 18.6% of all electricity. Coal is number three, producing 16.2%. Wind produces 10.2% and solar 3.9%, pointing out the futility of claims that “renewables” are about to dislodge fossil energy in electric generation any year now. With the rise of data centers and artificial intelligence (AI) that uses enormous amounts of electricity, building new gas-fired power plants and buying existing gas-fired plants is suddenly all the rage.

According to a recently released report by energy analytics firm Enverus, the U.S. will build as many as 80 new gas-fired power plants by 2030. With the announcement last week that Constellation Energy (the country’s largest nuclear power generator) is buying Calpine (the country’s largest natural gas-fired power generator) for $16.4 billion, the M&A space for gas-fired power plants is already higher in 2025 than either 2024 or 2023.

The sudden renewed interest in gas-fired power doesn’t sit well with radicalized environmental groups like the Sierra Club and Clean Air Task Force. Oh well, they can go pound frac sand.

We have several articles to share. The first is from the left-leaning Financial Times(London), which reports AI will fuel a surge in new U.S. gas-fired power over the next five years:

The US is on the cusp of a natural gas power plant construction boom, as Big Tech turns to fossil fuels to meet the huge electricity needs of the artificial intelligence revolution — putting climate targets in peril.

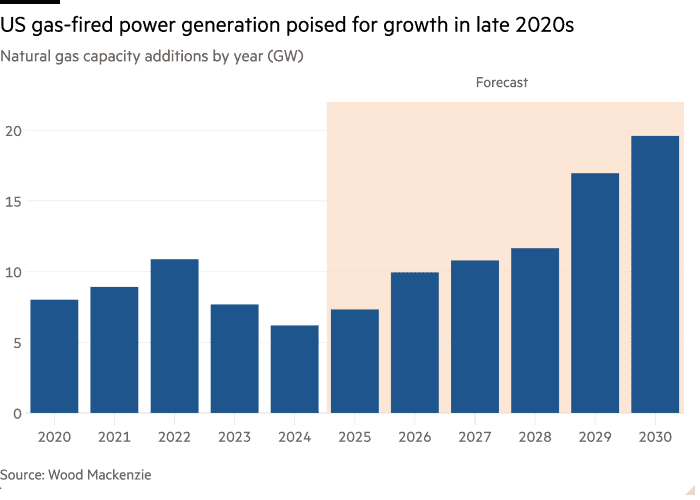

As many as 80 new gas-fired power plants will be built in the US by 2030, said energy consultancy Enverus, adding 46 gigawatts of capacity — the size of the electricity system in Norway and nearly 20 per cent more than was added in the past five years.

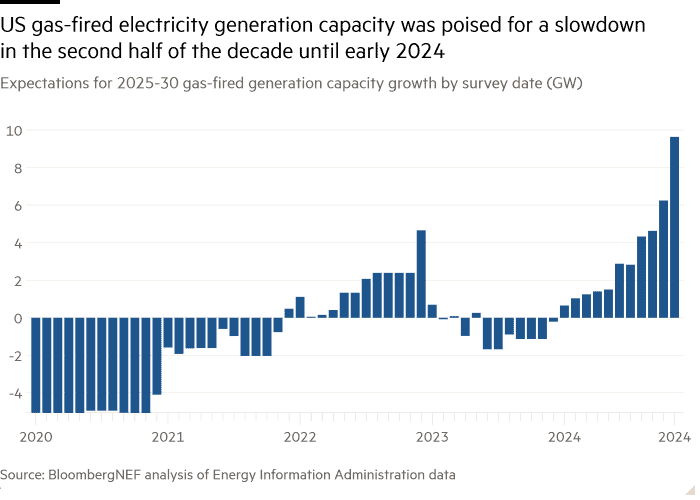

The capacity surge is expected to unfold during the second presidential term of Donald Trump, who has vowed to keep fossil fuels at the centre of the US economy, and signals a reversal of earlier forecasts for natural gas capacity to fall in the next five years.

“Gas is actually growing faster now, and in the medium term, than ever before,” said Corianna Mah, a research analyst at Enverus.

The expansion will imperil Biden administration climate targets, which called for greenhouse gas emissions to fall by 50-52 per cent from 2005 levels by the end of the decade and the grid to be 100 per cent carbon-pollution free by 2035.

“For natural gas to have a role in a decarbonised energy system, its emissions must be mitigated to the maximum extent possible,” said Armond Cohen, executive director at the Clean Air Task Force, an environmental non-profit.

US gas power plants emitted more than 1bn tonnes of carbon dioxide last year, up nearly 4 per cent in a year and the highest on record, according to data from Ember, an energy think-tank.

None of the planned gas plants tracked by Enverus will come equipped with carbon capture systems. While the Biden administration required new facilities to include the technology starting in 2032, Trump is expected to scrap or weaken the rule.

Wood Mackenzie and S&P Global Market Intelligence said US capacity growth in total could increase even more quickly, by 35 per cent and 66 per cent, respectively, over five years, compared with the buildout in the previous half decade.

The gas boom comes as the US races against China to develop AI and tries to bring back manufacturing lost to Asia in recent decades, sparking a historic surge in demand for cheap electricity that can run uninterrupted.

The US is already the world’s biggest natural gas producer thanks to its huge shale reserves. This helped keep domestic prices for the fuel relatively low, even during Europe’s energy crisis, and has underpinned the boom in seaborne exports.

Although clean energy supplies are also rising across the US — boosted by vast subsidies in the Inflation Reduction Act — developers say intermittent renewables, even with new batteries, are not yet adequate to meet the needs of big consumers.

“Your ability to serve that kind of load reliably is very limited with traditional renewables,” said Matt Bulpitt, vice-president of power development at Entergy, a large utility in the south.

In December, Entergy announced a $3.2bn plan to build three gas plants totalling 2.3GW to serve Meta’s $10bn AI data centre, the tech company’s largest. Meta will become Entergy’s “single largest customer” once the centre is online, the utility told the Financial Times.

US power consumption, known in the industry as “load”, is already at a record high but will leap by another 16 per cent by 2029, according to think-tank Grid Strategies.

The US Department of Energy says electricity demand from data centres used for AI will triple in the next three years.

The forecasts for such growth in gas-fired generation are upending earlier forecasts. As recently as December 2023, the US Energy Information Administration expected a net decrease in gas-fired generation capacity from 2025 to 2030, according to analysis of EIA data shared with the FT by BloombergNEF.

Other companies are now racing to catch up with the US’s gas needs.

“I wish I could’ve predicted it 18 months ago,” said Bill Newsom, chief executive of Mitsubishi Power Americas, a division of one of the world’s largest gas turbine manufacturers. The company planned to invest “hundreds of millions” to expand its manufacturing capacity by as much as 50 per cent in the next three years, Newsom told the FT.

Share prices of utilities and turbine manufacturers, including Siemens Energy and GE Vernova, have risen sharply over the past year.

Big Oil producers, including ExxonMobil and Chevron, are also entering the business, designing plants to supply AI data centres directly, avoiding the grid.

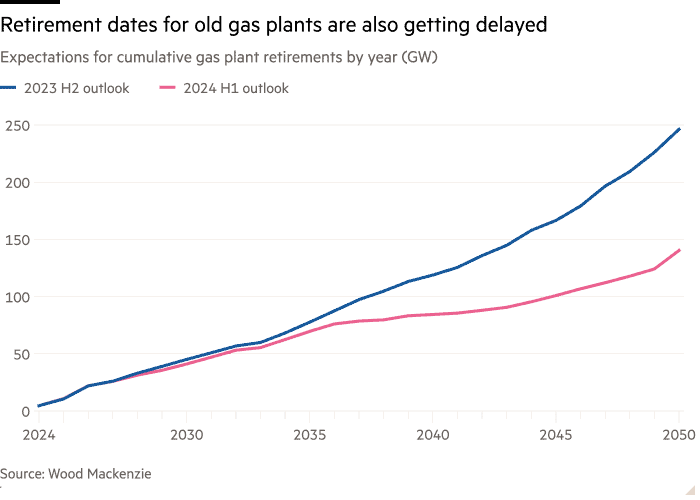

Some producers are keeping ageing gas plants around, while others are building scale through acquisitions. Last year, Wood Mackenzie revised down 2035 expectations for total US gas plant retirements by 10 per cent.

On Friday, Constellation Energy, one of the country’s largest electricity providers, announced that it was buying Calpine, the largest independent power producer of gas, in a deal worth nearly $27bn, marking one of the largest deals in the power sector.

Texas, Tennessee, and South Carolina lead the expansion of new gas capacity, according to S&P. The switch from coal to gas is also fuelling this growth.

“Like everybody else in the world, we want renewables to catch up. We’re all in favour of the cleanest energy possible. The reality is, it’s going to take a long time for that to become more prevalent,” said Bob Warden, managing director at private equity firm Fortress Investment Group, which earlier this week acquired 850MW of mobile gas turbines. (1)

The second article we have comes from Utility Dive and talks about 2025 being a banner year for M&A in the gas-fired power space:

Dive Brief:

Overall U.S. generation M&A held steady in 2024, but the “pendulum” of investment has swung from renewable energy to natural gas and other dispatchable energy assets, according to Scott Wilmot, an energy analyst at Enverus.

With Constellation Energy’s purchase of 60 GW from Calpine, which Wilmot estimated had an enterprise value of nearly $30 billion, total generation M&A for 2025 has likely already exceeded that of 2023 and 2024. Generation acquisitions totaled $22 billion in both years, according to Enverus.

This trend is likely to continue through 2025 as investors, utilities and corporations aim to build their portfolios of low-carbon generation assets to meet growing demand for electricity, Wilmot said.

Dive Insight:

The early 2020s opened the decade with large-scale acquisitions of renewable energy projects and portfolios, but 2025 is so far proving to be a banner year for natural gas.

Last week’s deal by Constellation represents one of the largest acquisitions of generation assets in recent U.S. history — and it was likely driven in no small part by Calpine’s sizable gas portfolio, Wilmot said. That represents a departure from the pre-2023 sales of competitive renewable energy portfolios by the likes of Duke Energy and AEP, but it’s also in line with a shift in energy markets that has been building for the past year, Wilmot said.

According to data from Enverus, the total value of natural gas plant acquisitions exceeded $4.3 billion in 2024, up from $3.1 billion in 2023. And those figures likely underestimate just how many natural gas plants have changed hands in recent years — they don’t count the value of plants sold as part of portfolios that included more than one type of generation resource, Wilmot said.

The value of all generation acquisitions and mergers did not change between 2023 and 2024, Wilmot said. Sales of solar generation remained mostly steady in 2024, but wind acquisitions declined somewhat, offsetting the increased natural gas activity.

“I feel like natural gas was a dirty word for a while. Everyone was so focused on emissions, the cost of renewables coming down, lucrative tax credits, and a lot of the focus on deal activity prior to late 2023 was on strictly renewable assets,” Wilmot said. “But now you have data centers and load growth entering the equation, and this is kind of like a fundamental turning point for how folks are looking at the grid.”

It’s not just that the number of natural gas deals has increased. The value of individual gas plants has, based on last week’s announcement by Constellation, roughly doubled since 2020, Wilmot said.

What buyers are willing to pay for other dispatchable energy resources, especially geothermal and nuclear, has also increased rapidly in recent years, according to Wilmot. However, he said these resources require long development timelines, and so the short-term growth potential for both remains limited. Natural gas, he said, is the easiest way for utilities and corporations to meet more immediate energy needs.

Renewable energy M&A, meanwhile, has seen a bit of a slowdown in recent months, and is likely to remain somewhat slow for the year to come, Wilmot said. Many financiers remain wary of these projects given the uncertain fate of tax credits create by the Inflation Reduction Act under the Trump administration.

“It really is a perfect storm for natural gas — rising demand, rising power prices, and increased risk around traditional renewables,” Wilmot said. “It’s really easy to see why people are pivoting to natural gas in this climate.” (2)//

The news from last week about the Constellation purchase of Calpine:

Constellation Energy will acquire Calpine in a deal with an equity purchase price of $16.4 billion, the two energy giants announced Friday. The combined entity will own almost 60 GW of nuclear, natural gas, geothermal, hydro, wind, solar, cogeneration and battery storage.

Initial reaction from the financial community was positive, with S&P Global Ratings noting the combined company will be the largest U.S. power generator with the potential to hedge output across varying markets. But investment banking firm Jefferies noted concerns around market power and possible related divestitures, and said the deal may face opposition.

Shares of Constellation traded up about 20% following the announcement. Calpine is a private corporation.

Constellation and Calpine said the deal “creates the cleanest and most reliable generation portfolio in the U.S., with a diverse, coast-to-coast portfolio of zero- and low-emission generation assets.” The new company will include “a significantly expanded presence in Texas, the fastest growing market for power demand, as well as other key strategic states, including California, Delaware, New York, Pennsylvania and Virginia,” they said.

The deal is a cash and stock transaction composed of 50 million shares of Constellation stock and $4.5 billion in cash plus the assumption of approximately $12.7 billion of Calpine net debt. The net purchase price is $26.6 billion, the companies said.

By combining Constellation’s nuclear generation with Calpine’s gas and geothermal fleet, “we will be able to offer the broadest array of energy products and services available in the industry,” Constellation President and CEO Joe Dominguez said in a statement.

Calpine’s gas plants “will play a key role in maintaining grid reliability for decades to come as customers transition to cleaner energy sources,” the companies said. “At the same time, Constellation will invest in adding more zero-emission energy to the grid by extending the life of existing clean energy sources, exploring new advanced nuclear projects, investing in renewables and increasing the output of existing nuclear plants.”

Constellation also plans to restart the 835-MW Three Mile Island Unit 1 nuclear generating station in Pennsylvania in 2028, the company announced in September. The recommissioned unit will be called the Crane Clean Energy Center. (3)

Calpine owns many gas-fired power plants in the Marcellus/Utica region, including the Bethlehem Energy Center, which saved Christmas in 2022 (see Bethlehem Marcellus-Fired Power Plant Kept PA Lights on During Xmas).