HEADLINE: “IEA Reports 2025 Energy Investment Hitting $3.3 Trillion: A Deep Dive into Markets, Countries, and Data Access” STU TURLEY

“The International Energy Agency (IEA) has released its World Energy Investment 2025 report, projecting global energy investment to reach a record-breaking $3.3 trillion in 2025.”

IEA Reports 2025 Energy Investment Hitting $3.3 Trillion: A Deep Dive into Markets, Countries, and Data Access

JUN 6

The International Energy Agency (IEA) has released its World Energy Investment 2025 report, projecting global energy investment to reach a record-breaking $3.3 trillion in 2025. This milestone reflects a 2% increase from 2024, driven by energy security concerns, economic uncertainties, and the accelerating transition to clean energy technologies. With clean energy attracting twice as much capital as fossil fuels, the report highlights a transformative shift in the global energy landscape. We are seeing a bifurcation in the energy space.

Which side will your country be on? Economic success, or fiscal failure?

Countries like the EU, UK, and Canada are moving towards Net Zero, which involves the 100% elimination of fossil fuels. In contrast, other countries, such as the U.S., are using a combination of approaches, including those that can produce more energy than it takes to create the energy source.

Wind, solar, hydrogen, and I would even put ethanol and other biofuels in the mix of energy sources that use more energy to be created than they can produce economically, and without a negative impact on the environment. There are some places where solar energy is critical, such as off-grid or on installations in West Texas on oil pads, but I am not convinced that solar or wind farms are a good thing. I have been installing solar panels for experiments on my microgrid, and it is costly, but great for people who can afford the backup and storage it provides.

In this article, we explore the key findings, break down investments across energy markets and countries, and, as I discussed on the podcast, the more money spent on renewable wind, solar, and hydrogen, the more fossil fuels will be used. We are not in an energy transition; we are in an energy addition, and we need to ask, "At what cost financially and to the environment?" One of my Guests on the Energy News Beat podcast calls my theory "Turley's Law," as we have been tracking it for years. And each year we find out the same thing: more money has been spent on renewable wind, solar, and hydrogen, and more coal, oil, and natural gas are used.

People tend to overlook the fact that the "Energy Transition" will never happen without fossil fuels, and the data show we are in an energy demand addition, not a transition. How can you make any of the 6000 products made from oil and gas without oil and gas? Can you design, manufacture, and transport an iPhone to consumers globally using only wind, solar, and hydrogen energy? I would say, not with the current technology that is deployed.

A Record-Breaking Investment Landscape

The IEA’s World Energy Investment 2025 report highlights that global energy investment is poised to surpass $3 trillion for the first time, with $2.2 trillion allocated to clean energy technologies and $1.1 trillion directed toward oil, gas, and coal. This shift signals the dawn of the “Age of Electricity,” where investments in electricity generation, grids, and storage are 50% higher than fossil fuel supply spending—a stark contrast to a decade ago, when fossil fuels dominated by 30%. According to IEA Executive Director Fatih Birol, “Energy security is a key driver of this growth, as countries and companies seek to insulate themselves from a wide range of risks.”

What this report from the IEA fails to point out is that in the oil and gas sector, there is over $ 4 trillion of investment to meet standard decline curves and meet current demand levels. So, when will peak oil demand disappear, and when will EVs capture 100% of the market share?

The report attributes this surge to industrial policies, cost-competitive electricity-based solutions, and rising electricity demand from sectors like industry, cooling, electric mobility, data centers, and artificial intelligence (AI). However, geopolitical tensions and economic uncertainties have led some investors to adopt a cautious “wait-and-see” approach, though existing projects remain largely unaffected.

Breakdown by Energy Markets

The $3.3 trillion investment is distributed across various energy markets, with clean energy technologies leading the charge. Here’s a detailed look at the key sectors:

Renewables: Investment in low-emissions power generation, particularly solar photovoltaic (PV), is a major driver. Solar PV, both utility-scale and rooftop, is expected to attract $450 billion in 2025, making it the single largest item in the global energy investment portfolio. Wind power also contributes significantly, with renewables collectively accounting for one-third of global electricity generation.

Nuclear Power: Capital flows to nuclear power have increased by 50% over the past five years, reaching approximately $75 billion in 2025. In 2024, nine nuclear reactors began construction globally, with China leading by starting six.

Grids and Storage: Grid investments are projected to hit $400 billion in 2025, up from $300 billion annually between 2015 and 2021. Battery storage investments are surging, exceeding $65 billion in 2025, driven by the need for system flexibility amid rising renewable penetration.

Low-Emissions Fuels and Efficiency: Investments in low-emissions fuels, energy efficiency, and electrification (e.g., electric vehicles) are integral to the $2.2 trillion clean energy allocation. However, efficiency investments in buildings, such as retrofits, remain below required levels.

Fossil Fuels: Despite the clean energy boom, $1.1 trillion will be invested in oil, gas, and coal in 2025. Upstream oil and gas investment is expected to decline by 4% year-on-year, with U.S. tight oil spending falling nearly 10%. Meanwhile, liquefied natural gas (LNG) facilities are on a strong upward trajectory, with projects in the United States, Qatar, and Canada set to boost global LNG capacity significantly between 2026 and 2028. Coal investment remains notable, particularly in China and India, driven by the growth in electricity demand. This number is far short of just meeting normal decline curves as mentioned above. If India continues its path of growth and demand, and can outpace the slowdown in China's economy, we will see higher oil prices with insufficient drilling activity to meet demand. I have other articles laying this portion out.

Source: IEA

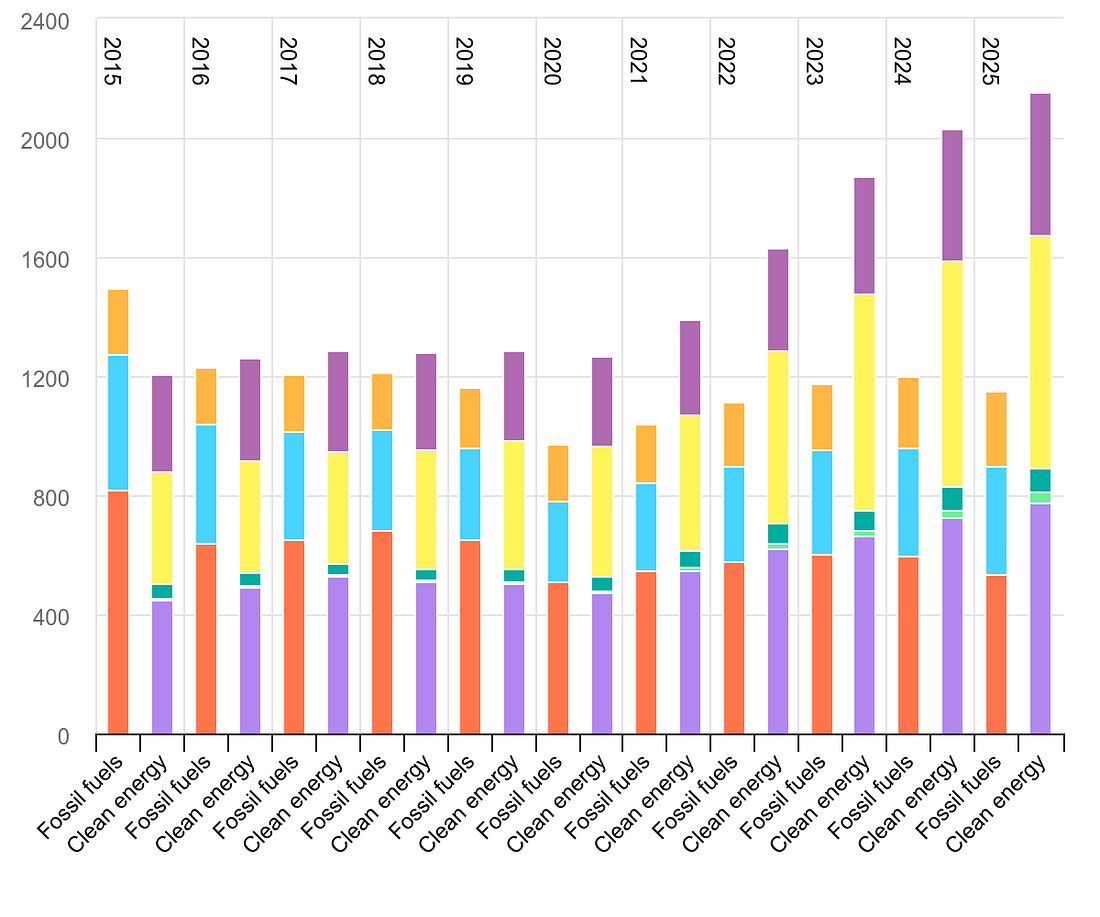

The report highlights that the ratio of clean power to fossil fuel power investments has soared from 2:1 in 2015 to 10:1 in 2024, underscoring the rapid pivot toward "sustainable" energy systems. I would ask, for the trillions of dollars spent on wind, solar, and hydrogen, how has the price decreased to consumers? In short, it has not. I also included "sustainable" energy systems, as that term encompasses wind, solar, and hydrogen; however, they are not sustainable financially.

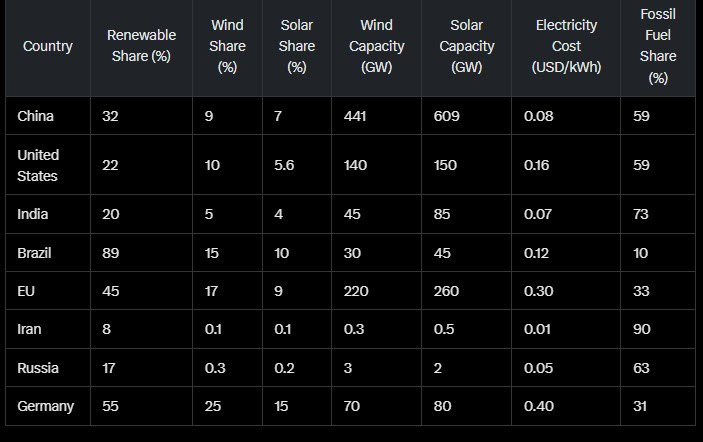

The answer lies in the electricity prices and the comparison to each country's energy mix. Brazil is one of the notable exceptions due to its vast hydroelectric power resources. As we examine the chart below, a strong correlation is evident between the percentages of wind, solar, and electricity prices.

Germany clocks in with 31% fossil fuels, but has the highest energy cost, and Iran, at 90% fossil fuels, has the lowest energy costs. Brazil, as mentioned above, has a large amount of hydroelectric power available and charges a higher price, as it is also investing in wind and solar energy. Russia has substantially more industrial capabilities than Iran, with a mix of 63% industrial, 20% nuclear, and limited wind and solar energy.

The bottom line on this chart. The more fossil fuels and nuclear power an industrial nation has, the more it will be able to industrialize and have economic freedom. The key is to do it while protecting the environment.

Investment Trends by Country and Region

Investment patterns vary significantly across countries and regions, reflecting economic priorities, energy needs, and access to capital:

China: As the world’s largest energy investor, China is cementing its dominance in clean energy, particularly in solar PV, nuclear, and electric vehicles (EVs). In 2024, China accounted for nearly two-thirds of global EV sales, with a 40% annual growth rate. Its coal-fired generation, however, remains a significant factor, contributing to over half of the world’s coal-based electricity.

The United States is a leader in LNG export capacity, with projects under construction that promise to double its export capacity by 2028. Investments in renewables, grids, and nuclear energy are also increasing, supported by the new administration.

India: Strong electricity demand growth (forecast at 6.3% annually through 2027) drives investments in coal and renewables. Coal provides nearly three-quarters of India’s electricity, but renewables are expanding rapidly, contributing over 20%.

Europe: The European Union is witnessing a decline in coal and gas demand, as investments in renewables and efficiency reduce reliance on fossil fuels. However, Europe faces higher energy costs compared to the U.S. and China, impacting industrial competitiveness.

Africa: Despite hosting 20% of the global population, Africa accounts for just 2% of clean energy investment. Total energy investment on the continent has declined by a third over the past decade, primarily due to a decrease in spending on fossil fuels and insufficient growth in clean energy. The IEA emphasizes the need for scaled-up international public finance to bridge this gap.

Emerging and Developing Economies: These regions, which represent two-thirds of the global population, receive only 54% of global energy investments. High financing costs and regulatory barriers hinder the deployment of clean energy, necessitating policy reforms and risk-mitigation tools, such as guarantees. Organizations like the IMG typically only approve "sustainable and renewable" wind and solar energy, when natural gas would be much more economical.

The IEA’s report calls for targeted actions to mobilize private capital in developing economies, particularly through initiatives like the “Baku to Belem Roadmap” launched at COP29, aiming to secure $1.3 trillion for low-emissions projects by 2035.

Critical Perspective: What’s Missing?

While the IEA’s report paints an optimistic picture of clean energy growth, it overlooks several key challenges. The uneven distribution of investments, favoring advanced economies and China, leaves developing nations, particularly in Africa, struggling to meet rising energy demand. The reliance on public finance to “de-risk” private investments raises questions about accountability and effectiveness. Moreover, the continued $1.1 trillion investment in fossil fuels, especially coal in China and India, undermines net-zero ambitions, suggesting a slower transition than the IEA’s rhetoric implies.

Additionally, the report’s focus on headline figures, such as $3.3 trillion, masks the cost inflation and supply chain pressures that erode real investment gains. For instance, nearly half of the $200 billion increase in 2022 was absorbed by higher costs rather than new capacity. Analysts should approach the IEA’s projections with skepticism, cross-referencing with primary data and regional policy developments.

Conclusion

The IEA’s World Energy Investment 2025 report signals a pivotal moment for global energy markets, with $3.3 trillion in investments reflecting a decisive shift toward “clean energy”. What I am seeing is something entirely different.

I am seeing the world bifurcate into two camps—those following the green “clean energy” path are leading to financial and fiscal failure. Net Zero, with large amounts of wind and solar, is just part of the costly fiscal collapse and deindustrialization.

As the world navigates geopolitical risks and economic headwinds, the challenge lies in ensuring equitable investment flows to emerging economies and addressing the structural barriers to a more balanced distribution of energy that relies on physics and fiscal responsibility. Without adhering to physics and being fiscally sound, the grid will collapse, and financial markets will fail. There are places for wind, solar, and hydrogen, but we need first to determine at what cost and whose feet the bill falls. There should never be a wind or solar farm installed without land reclamation fully integrated into the project's life cycle.

As of today, “Turley’s Law” has been extended a few more years by the IEA report.

Michael, the team at the Sandstone Group truly appreciates all of our podcasts, Substack, and the folks who provide comments and support. Thank you, it makes it fun.

Stay tuned to Energy News Beat for more updates on the evolving energy landscape.

Sources: International Energy Agency (IEA) World Energy Investment 2025 Report, IEA Data and Statistics, Posts on Xj

BOTTOMLINE: As the world navigates geopolitical risks and economic headwinds, the challenge lies in ensuring equitable investment flows to emerging economies and addressing the structural barriers to a more balanced distribution of energy that relies on physics and fiscal responsibility. Without adhering to physics and being fiscally sound, the grid will collapse, and financial markets will fail. There are places for wind, solar, and hydrogen, but we need first to determine at what cost and whose feet the bill falls. There should never be a wind or solar farm installed without land reclamation fully integrated into the project's life cycle.

Excellent analysis and summary. Thank you

I cannot thank you enough for this article.This Information is very important as it takes a view from a high and show details that are not seen often or at all.Opens up new eyes!! I will share this with my group so we can use this data for our fight. Stu,You are the best!!