HEADLINE: “This RTO Could See Blackouts By 2028: Save the coal, spare the blackouts” By ISAAC ORR AND MITCH ROLLING

“How soon could we reasonably expect first blackouts to affect region, based on announced coal retirements and historical fluctuations in hourly wind and solar generation, as well as electricity….”

This RTO Could See Blackouts By 2028

Save the coal, spare the blackouts

Surprise! It’s MISO

In its 2024 Long-Term Reliability Assessment (LTRA), the North American Electric Reliability Corporation (NERC) identified the Midcontinent Independent System Operator (MISO) as the region most at risk of rolling blackouts, stating the regional transmission organization (RTO) “falls below established resource adequacy criteria in the next five years.”

NERC warns:

MISO’s capacity resource turnover continues to occur with coal unit contributions being primarily replaced by solar, wind, and battery facilities. Furthermore, generation installation delays result in uncertainty throughout the assessment timeframe. As a result of these factors, MISO is facing capacity shortfalls beginning in 2025.

This prompted us to wonder: How soon could we reasonably expect the first blackouts to affect the region, based on announced coal retirements and historical fluctuations in hourly wind and solar generation, as well as electricity demand? And how bad might these blackouts be if more reliable power plants are retired through 2030?

Setting the Table: Coal Plays an Important Role in MISO

As we discussed in our article, Chris Wright is Right: Keep the Coal Plants Running, coal provides essential reliability attributes to the regions that depend upon it at a very affordable price.

According to the MISO Planning Resource Auction (PRA) for Planning Year 2024-2025 Results Posting, the 36,895 MW of coal that cleared the capacity auction in 2024 constituted 27 percent of the region’s summer planning reserve margin requirements, making it the second-largest source of reliable power plant capacity after natural gas.

Accredited capacity is the amount of power plant capacity that MISO believes can reliably show up during periods of peak demand. This metric considers factors such as forced outage rates, the need for thermal plants to go offline for maintenance, and the inherent variability of electricity production from wind and solar resources.

It can be assessed annually or seasonally by attributing “capacity values” to each resource, which represent a percentage of a power plant’s nameplate capacity that can be relied upon to meet peak demand.

The graph below shows a rough estimate of capacity values in MISO. Coal, natural gas, nuclear, and oil-fired resources receive significantly higher capacity values than wind, solar, and battery storage, indicating that they are more valuable to the system in terms of reliability.

Here, it’s worth noting that coal, nuclear, and natural gas punch above their weight in terms of delivering reliable capacity to the MISO system compared to their overall installed capacity.

For example, due to its 81 percent capacity value, coal capacity makes up 27 percent of accredited capacity even though it constitutes 22 percent of the installed capacity on the MISO system. Likewise, natural gas accounts for 40 percent of installed capacity but 42.5 percent of accredited capacity, and nuclear accounts for six percent of installed capacity and 8.5 percent of accredited capacity.

In contrast, wind and solar account for 16 and 7 percent of installed capacity, respectively, and account for just 3.8 and 3.6 percent of accredited capacity, respectively.

Looking Ahead: Despite Wind and Solar Additions, Coal Retirements Undermine MISO Reliability

The graph below shows the estimated installed capacity on MISO from 2024 through 2034. The total installed capacity is expected to increase from approximately 210,000 MW to around 240,000 MW as wind and solar installations expand to a combined capacity of slightly more than 90,000 MW.

However, accredited capacity declines in the years after 2027, especially in relation to the rising peak demand, because the retirement of coal plants hurts grid reliability far more than adding wind and solar helps it.

The graph below shows that the accredited capacity of coal in MISO could decrease from approximately 38,223 megawatts (MW) of capacity (MISO and NERC have slightly differing numbers) to 17,977 MW by 2028 if announced coal plant closures are implemented.

When paired with the high load growth scenario in MISO’s Long Term Load Forecast, which assumes a 2 percent compound annual growth rate for power, we see that the region will become reliant upon wind and solar to keep the lights on during times of peak demand.

As many of you probably guessed, this won’t end well.

When accounting for normal unit outages at thermal plants and comparing the MISO grid of the future against historical hourly wind and solar capacity factors as well as fluctuations in electricity demand, we discovered 2028 would be the first year MISO could theoretically see blackouts, if wind and solar perform as they did during the year 2020.

The first shortfall would occur on July 5th, but the big one would occur on July 6th, with a maximum shortfall of 17,100. For context, that would constitute 14 percent of the total demand in MISO during the time of the blackout, meaning roughly 6.3 million Americans living in MISO would be without power. This is roughly the size of the state of Missouri.

Things get worse beyond 2028 as more coal plants are retired. The graph below shows the cumulative retirement of thermal resources (mostly coal) and compares it to the installed and accredited capacities of wind and solar. It also displays the annual megawatt-hours (MWh) of unserved load each year on the secondary axis.

The shortfalls were small in 2028, but they would increase exponentially from 2029 to 2030 to over 1.9 million megawatt-hours (MWh) of unserved demand due to the additional closure of coal-fired power plants. This would equate to $19 billion in economic damages caused by the blackouts based on MISO’s Value of Lost Load calculation, which says every MWh of unserved load causes $10,000 in economic damages.

Perhaps some of these MWhs of unserved load could be offset by imports. MISO has historically been able to access large quantities of non-firm electricity imports from PJM to maintain grid reliability during times of system stress. However, growing demand for data centers in the Eastern Time Zone and the retirement of thermal capacity make this a risky gamble for grid reliability. In other words, PJM may not have a square to spare.

Fixing the Problem

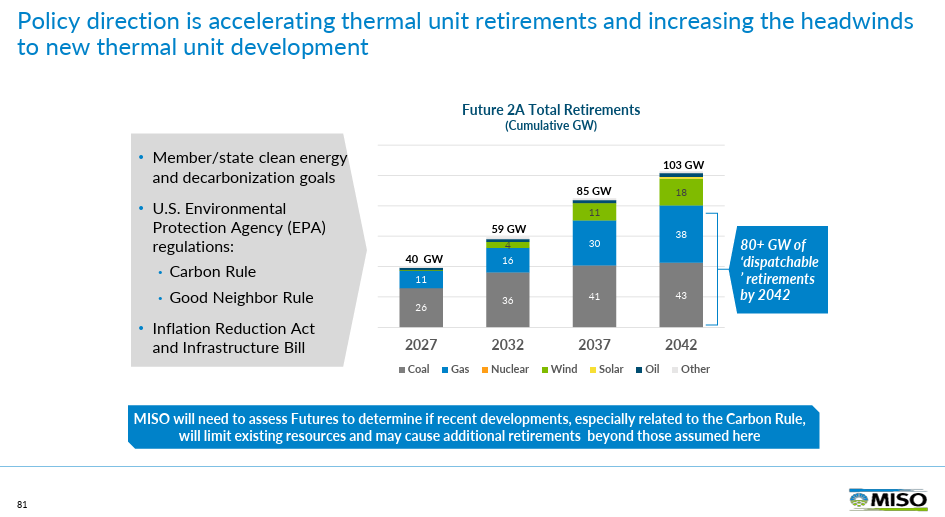

MISO is in a reliability hole, and the first thing it needs to do is stop digging. According to the RTO, public policies such as state carbon-free electricity goals, U.S. Environmental Protection Agency regulations, and Inflation Reduction Act subsidies are driving the closure of coal plants and increasing the headwinds for building new natural gas plants.

To stem the bleeding, MISO recommends keeping the existing coal plants running as the best immediate lever and relaxing renewable energy mandates.

Conclusion

Our modeling indicates that the erosion of grid reliability happens gradually, then suddenly. The status quo of coal plant closures could cause blackouts by 2028, but by 2030, they are a near certainty, causing billions of dollars in damages and leaving 6.3 million people living in America’s heartland in the dark.

Years of irresponsible energy policies by the Obama and Biden administrations, coupled with carbon-free electricity mandates passed at the state level, have put vast swathes of the United States on a path to rolling blackouts and skyrocketing costs. The Trump administration’s repeal of these policies is a win for America.

As a next step, as we have written previously, we firmly believe that delaying the closure of the nation’s coal fleet is necessary to ensuring grid reliability while they unwind the damage done by the Biden EPA. We also believe that DOE should identify potential candidates for recommissioning shuttered coal facilities, making them available to help the United States meet the substantial electricity demand of data centers and new manufacturing facilities.

BOTTOMLINE: We also believe that DOE should identify potential candidates for recommissioning shuttered coal facilities, making them available to help the United States meet the substantial electricity demand of data centers and new manufacturing facilities.

Black outs unless we put coal back?

Capacity is not the same reliability!

However, accredited capacity declines in the years after 2027, especially in relation to the rising peak demand, because the retirement of coal plants hurts grid reliability far more than adding wind and solar capacity helps it.