“Here's The Real Hockey Stick”, BY ROBERT BRYCE

“New Treasury Department numbers show that soaring federal handouts for wind & solar dwarf all other energy-related provisions in the tax code and will cost taxpayers $421 billion by 2034.”

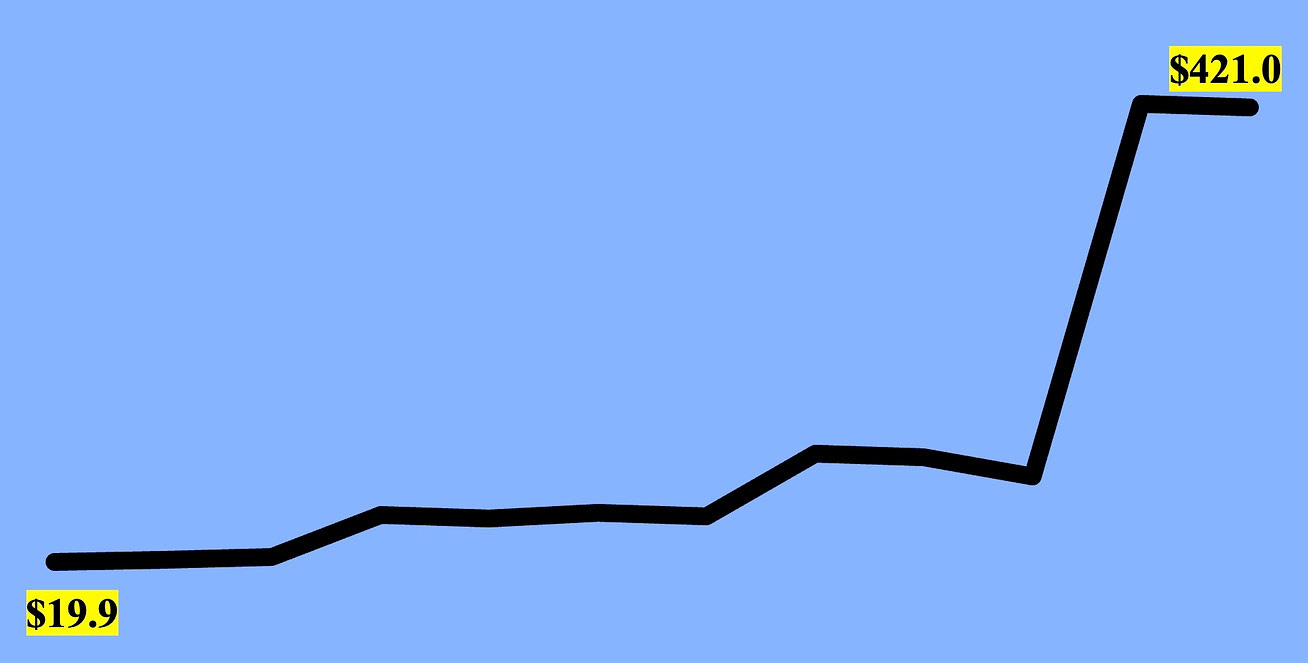

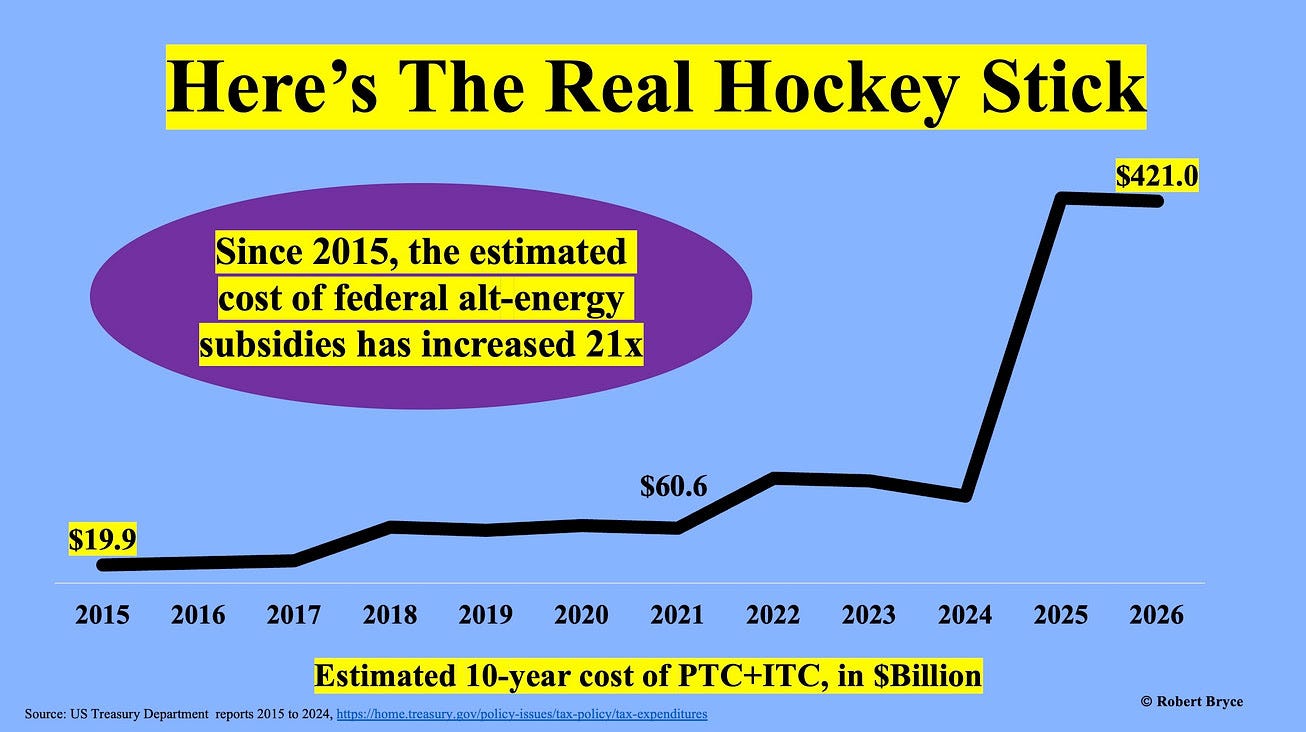

Here's The Real Hockey Stick

New Treasury Department numbers show that soaring federal handouts for wind & solar dwarf all other energy-related provisions in the tax code and will cost taxpayers $421 billion by 2034.

In 2005, Scientific American published an article saying that the hockey stick graph published a few years earlier by Michael Mann, an academic who now works at the University of Pennsylvania, had become “an iconic symbol of humanity’s contribution to global warming.” The article continued, saying the image, which shows a looming spike in temperature, has become “a focal point in the controversy surrounding climate change and what to do about it.”

That was an understatement.

Mann and the hockey stick have become defining examples of the politicization of climate science. The hockey stick played a prominent role in Mann’s defamation lawsuit against author and journalist Mark Steyn. Last year, a jury in Washington, DC, awarded Mann $1 million in that case. During the trial, Canadian journalist Terence Corcoran declared the hockey stick has become “a powerful and effective piece of supposed evidence for makers of climate policy and a near-religious icon that activists continue to revere.”

While scientists and journalists can argue about Mann’s hockey stick, his methods, greenhouse gas emissions, and temperature forcings, there can be no argument about the staggering cost of the subsidies Congress has given to Big Wind, Big Solar, and other alt-energy outfits in the name of climate change. In late November, the Treasury Department published the newest edition of its annual report on tax expenditures, which it says are “revenue losses attributable to provisions of Federal tax laws.”

What do those Treasury reports show? A hockey stick.

The Inflation Reduction Act, which became law in 2022 thanks to a single vote cast by Kamala Harris, has turned into a run on the Treasury. As seen at the top of this article, the IRA has fueled a hockey stick of gradual — and then exploding — federal tax expenditures for the investment tax credit and production tax credit. Those credits, which are the principal drivers behind the deployment of wind and solar energy, and a handful of other forms of alt-energy, are, by far, the most expensive energy-related provisions in the federal tax code. Between 2025 and 2034, the ITC and PTC will account for more than half of all energy-related tax provisions. And that total does not include the tax credits for electric vehicles.

This alt-energy tax credit orgy is, of course, being justified by claims that the expenditures will help avert catastrophic climate change. The Natural Resources Defense Council (2023 revenue: $193 million) has claimed the IRA will cut “climate-warming emissions” while “reducing Americans’ electricity bills” and “creating hundreds of thousands” of jobs.

The NRDC’s claims are — to put it charitably — dubious. Meanwhile, the federal debt is $36.3 trillion. The incoming Trump administration says it wants to cut federal spending. If that’s true, Elon, Vivek, and their DOGE allies should start by looking at the real climate hockey stick.

I compiled the Treasury tax expenditure data from 2015 to today. Here’s a deep dive into those numbers with five fab charts.

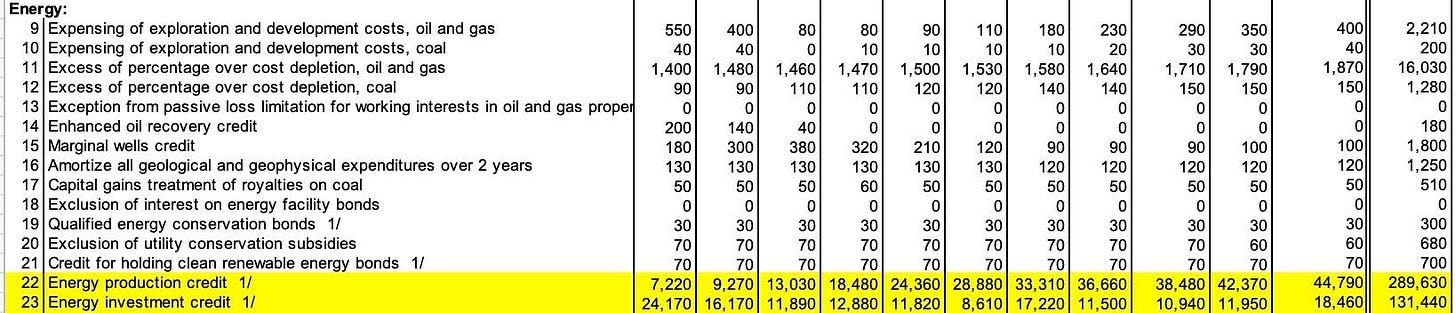

When it comes to understanding tax policy, the Treasury Department’s tax expenditure reports are among the best documents published by the federal government. The reports, which can be read in PDF and downloaded as spreadsheets, itemize all types of tax favoritism, ranging from deductions for interest on home mortgages to tax credits for maintaining railroad tracks. The agency tracks the annual cost of each tax provision and estimates what those provisions will cost over the next 10-year period.

As seen above, in its fiscal year 2026 report (the federal government’s fiscal year begins on October 1), the Treasury put the 10-year cost of the ITC and PTC at a staggering $421 billion. (See Table 1, lines 22 and 23.)

Between 2025 and 2034, the agency expects the ITC to cost $131.4 billion and the PTC to cost $289.6 billion. That $421 billion total is a 21-fold increase since 2015 and a nearly 7-fold increase since 2021, the year before the IRA became law.

Recall that on August 16, 2022, when President Joe Biden signed the IRA, he said the measure “invests $369 billion to take the most aggressive action ever — ever, ever, ever — in confronting the climate crisis.” But that $369 billion figure was an absurdly low estimate.

In 2023, Goldman Sachs estimated the IRA “will provide an estimated $1.2 trillion of incentives by 2032” for alt-energy, including tax credits for electric vehicles. Further, as I explained last year, the tax credits are permanent giveaways. Why? They are supposed to begin winding down by 2032 or when the power sector’s emissions are slashed by 75% compared to 2022 levels. But as the Cato Institute’s Travis Fisher has explained, even with a high uptake of IRA subsidies, power sector emissions may only decline by about 35% by 2050. Indeed, the idea that the US power sector will be able to slash its emissions by 75% — even by 2050 — is just wishful thinking. Further, as Fisher has noted, the consulting firm Wood Mackenzie estimates the cumulative cost of the IRA energy credits could reach as much as $3 trillion.

Of course, the companies that are feasting on this corporate welfare are loathe to back away from the trough. As the Wall Street Journal’sJennifer Hiller wrote this week, instead of claiming their juice is “clean,”alt-energy firms have begun claiming weather-dependent generation is needed to help the US meet growing electricity demand. The article quotes Jim Murphy, the president of Chicago-based Invenergy, which is majority-owned by Canada’s CDPQ. Invenergy, notorious for playing hardball when siting its projects in rural America, is the world’s largest privately held alt-energy firm. Murphy told Hiller, “If you look at the forecasts, we’re going to need everything as fast as we can get it.”

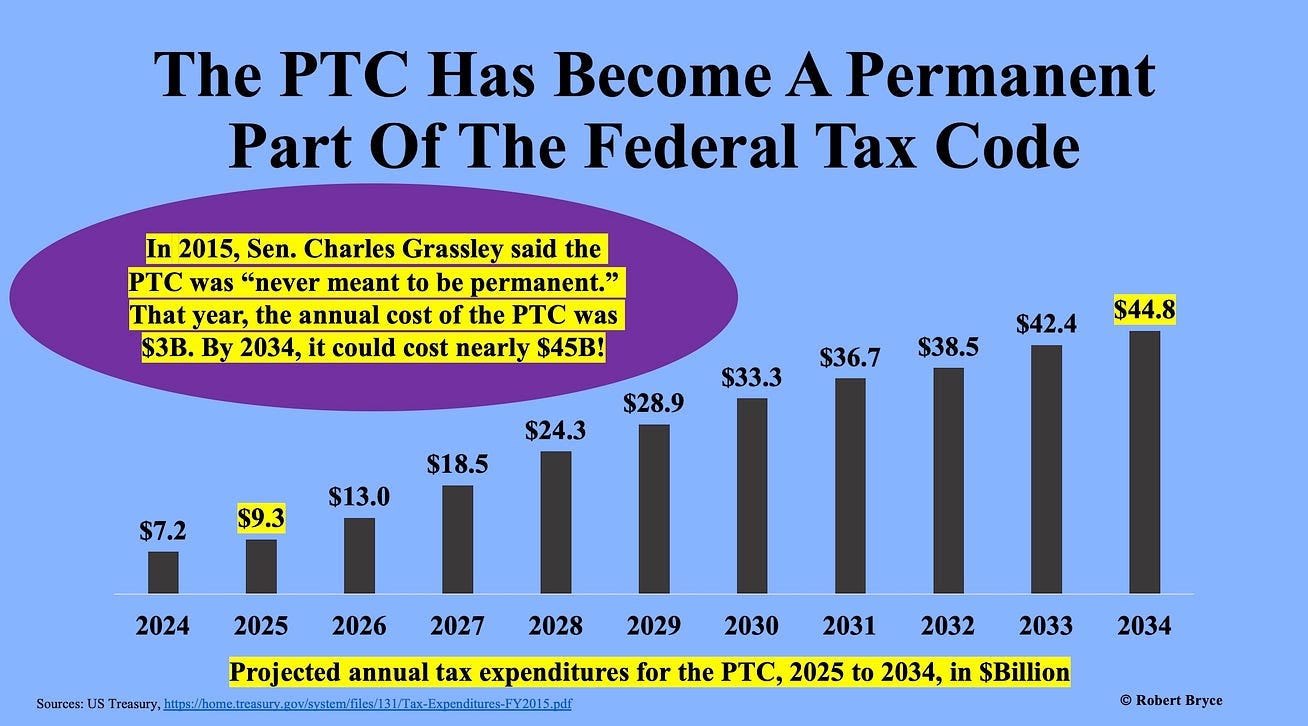

In other words, Murphy and his fellow travelers who are making bank from fat federal subsidies never want them to go away. And given the way the IRA was written, those subsidies won’t go away unless Congress acts. As seen above, in 2015, Senator Charles Grassley (R-Big Wind) declared, “As the father of the first wind-energy tax credit in 1992, I can say that the tax credit was never meant to be permanent.”

When Grassley, a self-proclaimed deficit hawk, who is now 91 — and the oldest member of the geriatric care facility formally known as the US Senate — uttered those words, the PTC was costing the federal treasury about $3 billion per year. In 2025, the cost will be $9.3 billion. Unless Congress amends, or repeals, the IRA, the annual cost of the PTC could soar to nearly $45 billion in 2034.

Further, the federal giveaways for wind and solar dwarf budgets for entire federal agencies. As seen above, in 2024, the ITC+PTC tax expenditures were nearly three times larger than the FBI’s budget. In addition, the cost of the ITC+PTC was more than six times greater than the combined budgets of the Fish & Wildlife Service and the National Park Service.

There’s more. Thanks to the IRA, the federal giveaways for wind and solar dwarf every other energy-related provision in the federal tax code. As seen above, Treasury puts the 10-year cost of all hydrocarbon tax expenditures at $23.5 billion and the nuclear power production credit at $47.4 billion. Thus, over the coming decade, thanks to the ITC+PTC, the alt-energy sector will get nearly 18 times more in federal tax credits than the entire hydrocarbon sector — which now provides about 81% of all US primary energy — and nine times more than the nuclear sector.

The punchline here is so obvious that Ray Charles could see it. In less than three weeks, the new Trump administration will take power. The federal debt is now at 123% of US GDP, and it is growing by about $1 trillion every three months. If Trump and his people are serious about shrinking the federal government and eliminating corporate welfare, the first place they should look is the IRA and the scandalous sums that are being given to Big Wind and Big Solar.

Thank you for this excellent article.

Imagine: if these funds went to developing nuclear power?