“Plug Power, Which Got A Last-Minute $1.66B Loan Guarantee From DOE, Reports $2.1B Loss”,

“The “green” hydrogen company’s 2024 losses were nearly triple its 2022 losses of $724 million. Given its lousy financial condition, why did the Biden DOE give it a loan guarantee?

Plug Power, Which Got A Last-Minute $1.66B Loan Guarantee From DOE, Reports $2.1B Loss

The “green” hydrogen company’s 2024 losses were nearly triple its 2022 losses of $724 million. Given its lousy financial condition, why did the Biden DOE give it a loan guarantee?

MAR 04, 2025

∙ PAID

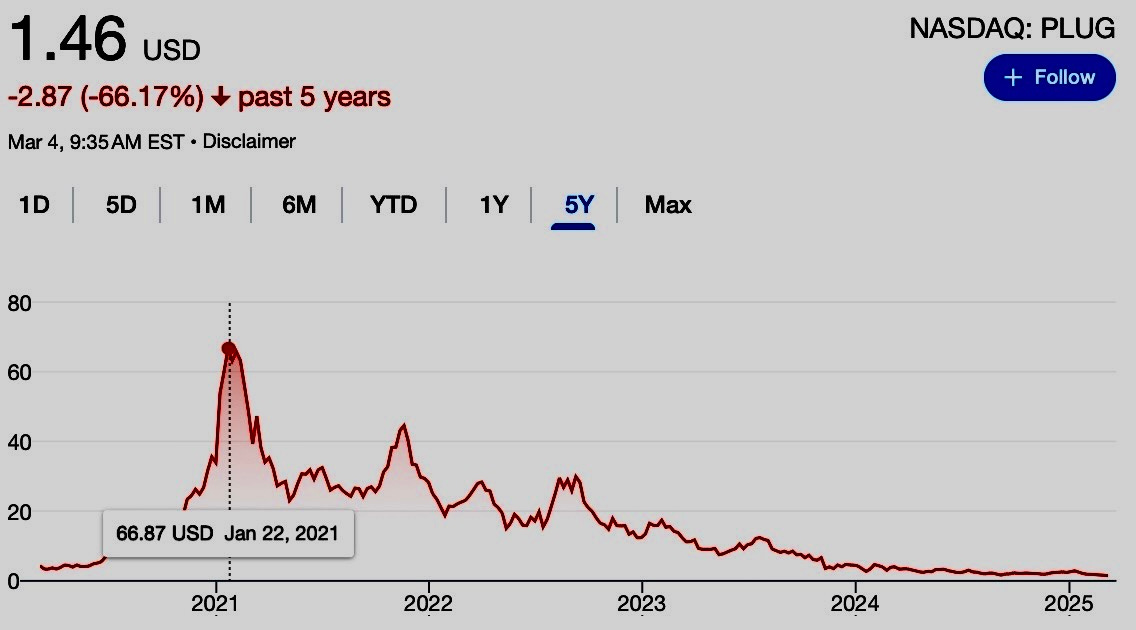

In 2021, Plug Power was surfing the wave of hydrogen hype. Its stock was selling for $66 per share, and the company said it was going to replace diesel fuel in transportation systems with “green hydrogen.” One of its presentations claimed, “our sales pipeline is robust and diverse.”

That was four years ago.

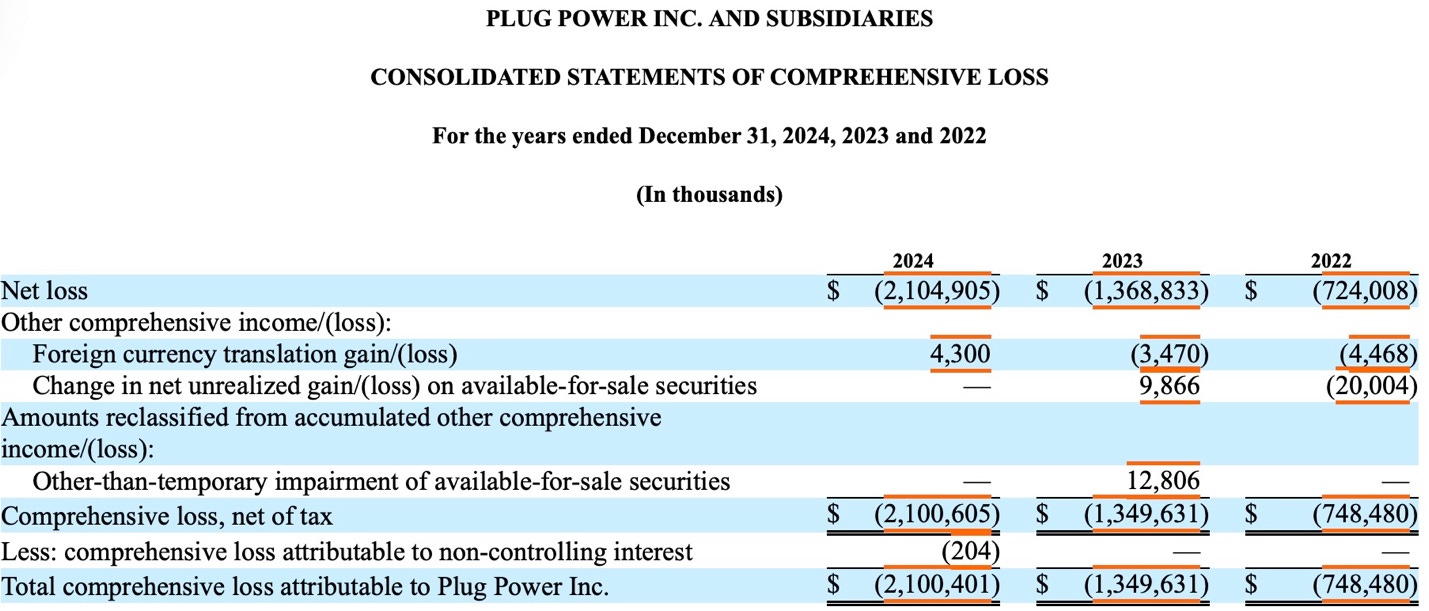

Yesterday, Plug reported a $2.1 billion loss for 2024, its stock price is falling, and the company is headed for bankruptcy. As I explained here on January 19, the Loan Programs Office, then headed by Jigar Shah, extended a $1.66 billion loan guarantee to Plug four days before Donald Trump was inaugurated. It announced the deal on January 16. In doing so, it ignored a December 17, 2024, report by the DOE’s Inspector General that urged the agency to halt all loans and loan guarantees until it could ensure that it is complying with “conflicts of interest regulations and enforcing conflict of interest contractual obligations.”

Plug’s shaky financial condition was apparent in January when the LPO extended the loan guarantee. In fact, Plug has been teetering on the edge of bankruptcy since November of 2023, when it warned investors about its ability to continue as a going concern. So why did the LPO give the company a loan guarantee?

Let’s take a closer look at the Plug story, which provides yet another example of how the Biden administration’s energy policies — and spending — were guided by ideology instead of realism.

To receive all new articles, post comments, and support my work, please consider becoming a paid subscriber.

The looming bankruptcy of Plug Power is only one part of the broader collapse of companies that have been peddling the hydrogen foolishness. Last month, Nikola Corporation, which was aiming to make hydrogen-fueled trucks, filed for Chapter 11 bankruptcy. In 2020, the company briefly sported a market capitalization of $30 billion. Since then, it’s all been downhill. Its founder, Trevor Milton, was convicted of misleading investors and was sentenced to four years in prison. As the AP notes, Milton was “prone to exaggeration” when discussing his company.

Last month, Michael Barnard, writing in CleanTechnica, published a list of 13 hydrogen companies that have gone bust. He noted that his “hydrogen death watch list has 128 firms on it.”

The destruction includes a shareholder revolt at Air Products, where the company’s CEO, Seifi Ghasemi, was forced out after activist investors pushed back against the company’s clean hydrogen plans. As one media outlet noted, investors were “highly critical” of the company’s plans for “clean hydrogen, arguing that its $15 billion project pipeline lacked sufficient accountability.” It continued, saying the “firm’s approach to clean hydrogen could face a recalibration.”

None of this should be overly surprising. Here’s what I wrote last October in “The Hydrogen Bust Is Here:”

Companies all over the world are canceling or delaying planned projects. Why? The entire notion of “green” hydrogen is a fool’s errand. As Steve Brick has memorably put it, hydrogen is a “thermodynamic obscenity.” As I explained, it takes about three units of energy, in the form of electricity, to produce two units of hydrogen energy. In short, getting to Plug’s “green hydrogen economy” requires scads of super-cheap electricity (a high-quality form of energy) to make a tiny molecule that’s hard to handle, difficult to store, and expensive to use.

That history makes the LPO’s loan guarantee all the more curious. Last June, Sen. John Barrasso (R-WY) issued a press release noting that the agency had made a conditional commitment to Plug. Barrasso wrote, “I have significant doubts about Plug Power’s financial viability. I understand the company has not turned a profit since its incorporation over 20 years ago.” Barrasso noted that Plug lost $1.4 billion in 2023 and $724 million in 2022.

In addition to the staggering losses, Plug’s revenues are falling. The company, which calls itself the “industry leader behind the end-to-end green hydrogen ecosystem,” recorded $390 million in equipment sales last year, a steep drop from the $711 million it reported in 2023.

Plug’s corporate moves also raise questions about its credibility and its viability as a going concern. On February 26, Plug said it was delaying its earnings report by a week, a move that almost always indicates bad news — or disarray, or both — at a company. Yesterday, the company issued a release saying it was at a “commercial inflection point” and would be cutting its workforce and “limiting capital expenditures to near-term critical requirements.” It’s also worth noting that Plug doesn’t publish its financial statements on its website. Instead, you have to find them on the SEC’s website. The same press release said the company has closed on the DOE’s $1.66 billion loan guarantee and was counting on the DOE loan to “cover approximately $400 million” of some $600 million the company was invested in an expansion project.

Given the myriad problems in the hydrogen sector and Plug’s shaky finances, why did the LPO give the company a loan guarantee? On January 20, the day after I published my piece on the loan guarantees, Shah contacted me via Twitter. After exchanging a few pleasantries, I asked him to answer these questions:

Why did you give a loan guarantee to Plug when the company has done nothing but lose money?

Were the financial prospects of Plug included in the decision making at LPO?

If not, why not?

Plug applied to the LPO in November 2020. But the LPO waited until four days before Biden’s term ended to make the loan guarantee. Why did you wait until the last minute?

Shah replied that he would only answer the questions if I had him on a podcast so he could “answer everything on the record with context.” I replied that the condition was unacceptable and that I wasn’t interested in doing a podcast. Shah again refused to answer the questions in writing.

What’s happens next?

Last week, the DOE announced it was pausing all loan closures at the LPO, and according to Politico, it has begun a “review of two specific projects that were recently finalized.” Presumably, those projects are the loan guarantees for Plug and EV maker Rivian, which got a $6.57 billion guarantee from the LPO. Like Plug, Rivian is losing knee-buckling sums of money. Last week, the EV company reported losing $4.7 billion in 2024 while delivering 51,579 vehicles to customers. Thus, Rivian lost about $91,000 for each EV it sold.

Here's a prediction: over the next few weeks, the DOE will cancel the loan guarantees to Plug and Rivian, and rightly so.

Before you go:

Please click that ♡ button, or you will be required to live in Britain.