The Climate Cartel and the Collusion and Corporatism That Are Its Trademarks

Based upon the evidence obtained by the Committee, the members of the climate cartel are colluding toward a common goal: the “decarbonization” of American industry

The Climate Cartel and the Collusion and Corporatism That Are Its Trademarks

JUN 16, 2024

Last Tuesday, the U.S. House of Representatives Judiciary Committed an interim staff report titled “Climate Control: Exposing the Decarbonization Collusion in Environmental, Social, and Governance (ESG) Investing.” It calls out the collusion among big banks and other’bigs’ (corporations, agencies, NGOs, etc.) in an effort to enforce the ‘climate crisis’ on us all so the grifting can continue.

Here is we learn from the Executive Summary (emphasis added):

The Committee has obtained evidence that a “climate cartel” of left-wing environmental activists and major financial institutions has colluded to force American companies to “decarbonize” and reach “net zero.”

Through their commitments to groups such as Climate Action 100+, the members of the climate cartel expressly have agreed to decarbonize the American economy by forcing corporations to disclose their carbon emissions, to reduce their carbon emissions, and to enforce (and reinforce) their disclosure and reduction commitments by handcuffing company leadership and muzzling corporate free speech and petitioning.

The climate cartel imposes these radical policies by weaponizing ever-escalating pressure tactics that start with negotiations with corporate management, continue to filing and “flagging” stockholder proxy resolutions, and culminate with taking out the boards of directors at “recalcitrant companies.

Subscribed

The climate cartel’s members include:

“convening” and “collaborating” groups like Climate Action 100+,the Net Zero Asset Managers initiative, and the Glasgow Financial Alliance for Net Zero (GFANZ);

blue state pension funds like the California Public Employees’ Retirement System (CalPERS);

radical environmental non-profit organizations like Ceres;

stockholder engagement service providers like As You Sow;

activist investors like Arjuna Capital, LLC (Arjuna), Trillium Asset Management, LLC, Engine No. 1 LP, and Aviva Investors Americas, LLC, which “acquire a minimal ownership stake . . . to stop climate change, not to make a financial profit”;

the “Big Three” asset managers BlackRock, Inc. (BlackRock), State Street Global Advisors (State Street), and The Vanguard Group, Inc. (Vanguard), who together own 21.9% and vote 24.9% of the shares of the Standard and Poor’s (S&P) 500; and

the foreign-owned proxy advisory duopoly of Institutional Shareholder Services Inc (ISS) and Glass, Lewis & Co. (Glass Lewis), which have a combined 90% market share and advise mutual funds controlling more than $27 trillion in assets.

The Committee has received documents from each of these members of the climate cartel. In total, as part of the investigation into ESG collusion, the Committee has now received and reviewed 272,294 documents and 2,565,258 pages of non-public information.

Due to their failure to produce responsive material timely and fulsomely, the Committee was forced to issue document subpoenas to GFANZ, Ceres, As You Sow, Arjuna, BlackRock, State Street, Vanguard, ISS, and Glass Lewis. In addition to documentary evidence, the Committee has completed transcribed interviews or depositions of the leaders of key players within the climate cartel.

This interim report focuses primarily upon the collusive conduct of Climate Action 100+, its co-founders Ceres and CalPERS, and its radical member Arjuna. Based upon the evidence obtained by the Committee, the members of the climate cartel are colluding toward a common goal: the “decarbonization” of American industry, which necessarily reduces output and increases prices for American consumers.

Thus far, the investigation has revealed how the climate cartel has escalated its attacks on American companies and is forcing companies to slash output of products and services that are critical to Americans’ daily lives. The Committee has found, among other things:

The climate cartel has declared war on the American way of life. The climate cartel is waging “a Global World War” for net zero against disfavored American companies, including those in the fossil fuel, aviation, and farming industries that allow Americans to drive, fly, and eat. It has described Climate Action 100+ as “the global Navy,” and compared Ceres’s efforts to “the Army ground troops” and “an ‘air cover’ strategic and silent bombing campaign by a newly funded division of the Air Force.

The climate cartel has agreed to force corporations to “decarbonize.” Members of groups like Climate Action 100+ expressly commit to engage “with the companies in which [they] invest” to make them reach “net zero [greenhouse gas (GHG)] emissions by 2050” by disclosing their carbon emissions, reducing their carbon emissions, and adopting enforcement mechanisms to strengthen these commitments.

The climate cartel “[r]amp[s] up” and “[e]scalate[s]” pressure against corporations on the “wrong side of climate history.” The climate cartel is “willing to go to the top rung” by filing shareholder resolutions, voting against management, and “replac[ing] board members” with those of its own choosing.

The climate cartel seeks to “keep fossil fuels in the ground,” raising prices and reducing output for American consumers. To reach net zero, as ESG activists demand, “fossil fuel use has to be reduced.” Airplane travel must be “capp[ed] . . . at 2019 levels” and “total flights” must be reduced by 12%. Food demand growth must be “reduce[d],” with beef consumption slashed to “about half of current U.S. levels.”

The climate cartel is not done attacking American consumers. Climate Action 100+ “is about action at this point, not just words/commitments/disclosure.” It has “mov[ed] beyond simple disclosure requests” and is now making “more ambitious” demands to companies. For the climate cartel, “the job is . . . only just begun.”

The Biden Administration has failed to meaningfully investigate the climate cartel’s collusion—let alone bring enforcement actions against its apparent violations of longstanding U.S. antitrust law. The Committee’s aggressive oversight, however, has led members of Climate Action 100+ to withdraw from the group.

On February 15, 2024, BlackRock, State Street, and J.P. Morgan Asset Management—three of the world’s largest asset managers—withdrew their “nearly $14 trillion of total assets” under management from Climate Action 100+, leaving the group without any “of the world’s five largest asset managers” as members.

By March 1, 2024, Pacific Investment Management Company, LLC and Invesco Ltd. — two of the “large[st] US asset managers still in Climate Action 100+” — had withdrawn as well. Dozens of other members also appear to have left Climate Action 100+ in recent months.

While this interim report examines the collusive conduct of Climate Action 100+, the Committee’s investigation into the broader climate cartel remains ongoing. The Committee will continue to examine the adequacy and enforcement of current antitrust laws to determine whether legislative reforms are necessary to protect competition in the American economy.

Good stuff, although Republicans typically talk a lot and then do little, so don’t put your faith in any politician. Nonetheless, the sunlight is extremely helpful as the Committee notes in taking credit for several outfits dropping out of Climate Action 100+. Do they deserve applause? I’m not sure but I’m willing to give them some and encourage them to keep digging and exposing.

Who are the members of Climate Action 100+ today? Well, Walmart is on the list, which tells you a lot about the company’s real commitment to the interests of its customers (approaching zero). So, are several oil and gas companies, too! What the hell is wrong with them? Well, they foolishly have gone the appeasement route, which is a dead-end they haven’t reached yet. Utilities accustomed to just passing costs along to consumers are also right there with the other virtual signalers.

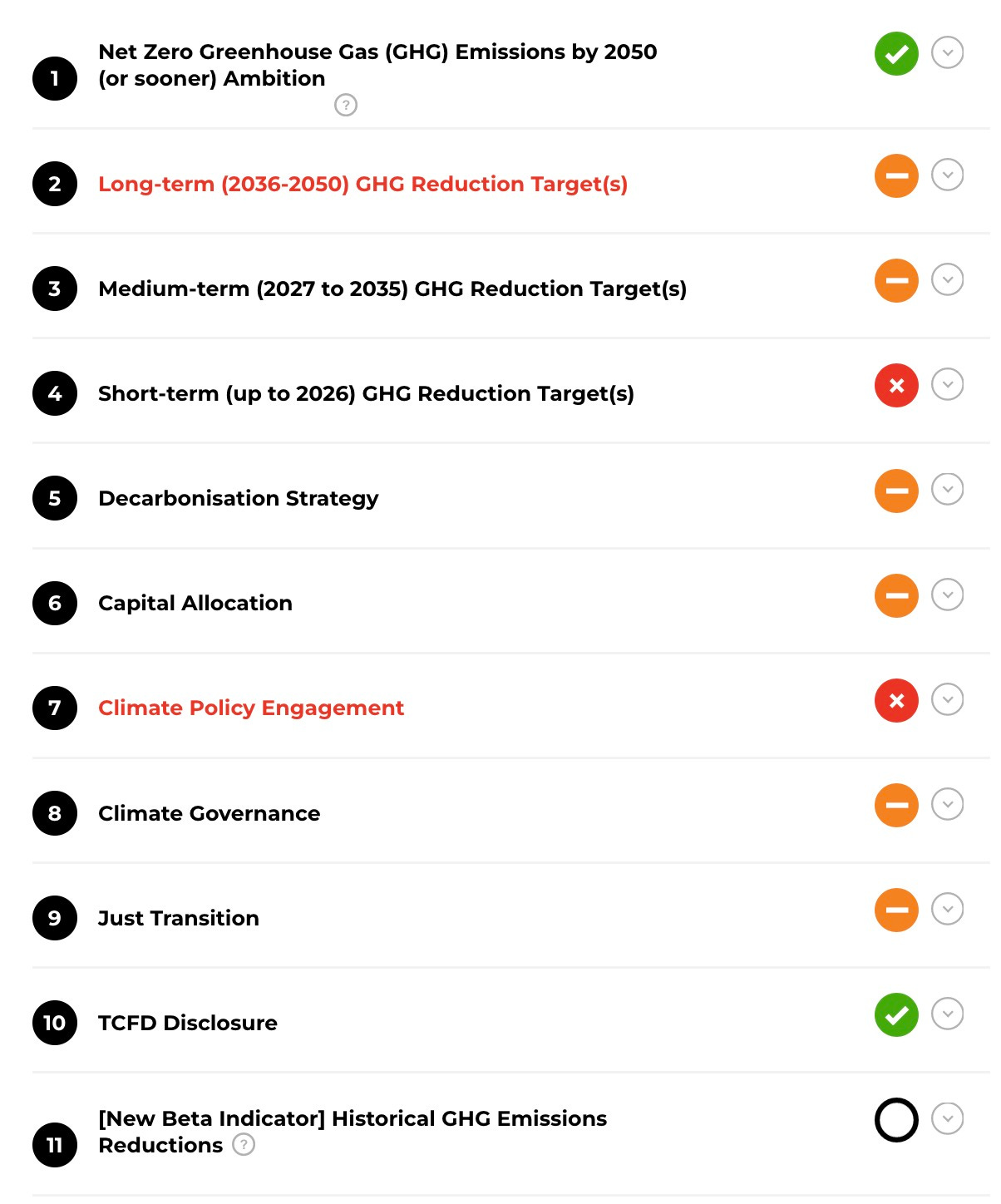

One that was particularly sad for me was PPL, which serves my part of the world. Here’s its rating:

The essence of this rating is that PPL, like the politicians, is more than pleased to commit to far-off goals and blow a lot smoke on climate changer, but, once again, it’s clearly more appeasement than anything else.

This is the typical utility approach. What they should be doing is warning their customers, their regulators and the PJM grid folks that this nonsense cannot go on much longer. They know that and realize that each new utility scale solar and wind project weakens grid stability and portends future problems. Hey, though, it’s America. We don’t react until there’s a crisis because most of our leaders are really followers and they wait for the public to catch up.

#Grid #PPL #ClimateCartel #ClimateAction100+ #Collusion

Thank you for this important reporting. The harms to Germany's economy coupled with the environmental degradation associated with their so-called decarbonization should be front and center. Putin's Russia benefited. German coal interests benefited. Here's a relevant June 13, 2024 article: https://greennuke.substack.com/p/lessons-from-germanys-wind-power The state of California is following the German playbook. Some of the coal interests that are economically benefiting are owned by Berkshire Hathaway Energy (BHE.) The GreenNUKE substack has been investigating BHE's conduct for some time. As a consequence, there is information consistent with BHE-led economic retaliation.

A note on BHE, they seem to be doing well in the Texas area too. I have heard that they have pushed for the Texas Energy Fund, whose applications stand at $38.5 million for the $5 million dollar fund. So you see where that will go. My contention and what that is worth - the State of Texas should never have become a banker, but policies drove them to no other conclusion but to fund gas peaker plants to be able to make it through the ups and downs of wind and solar and keep the lights on. Who didn't see that coming - just like ERCOT didn't see the doubling of necessary generation in the next 2 years. Really???

Politicians are good at patching the holes they create. They are not well versed in the language of energy and like all boards taking advise from experts, the road is always rosie ... we just have to get on it and get more people and more money to stay there!!!

As far as the consumer, just bend over, hand over your wallet and hold tight!