Report: Natural Gas is the #1 Choice for Electric Grid Stability

“Since 2014, the share of U.S. electricity generation from natural gas in summer has increased every year, increasing from 29% in 2014 to 45% in 2024 (see U.S. NatGas-Fired Electricity Hit New Record”

Report: Natural Gas is the #1 Choice for Electric Grid Stability

ELECTRICAL GENERATION | INDUSTRYWIDE ISSUES

November 1, 2024

Since 2014, the share of U.S. electricity generation from natural gas in the summer has increased every year, increasing from 29% in 2014 to 45% in 2024 (see U.S. NatGas-Fired Electricity Hit New Record High in Summer ’24). According to data from the U.S. Energy Information Administration (EIA), 43% of U.S. electricity was generated with natural gas in 2023. The second-highest source was nuclear, with 18%, followed by coal, at 16%. Unreliable wind produced 10% of all electricity for the U.S. in 2023, and solar around 4%. A new report from Enverus says natural gas has emerged as the “premier choice for grid stability” amid rising demand and coal retirements. Unreliable renewables are not up to the task.

We have two items to share. One is an article from Irina Slav, writing at OilPrice.com, pointing out how natural gas “reigns supreme” in the U.S. power grid. The other is a press release from Enverus about their new report fingering natgas as the best alternative to use for grid reliability.

From OilPrice.com:

To date, despite the substantial growth in wind and solar, gas remains the dominant energy source.

43 percent of U.S. electricity is generated with natural gas.

Power generation data from climate outlet Ember showed that natural gas had pushed the United States’ overall dependence on hydrocarbons for electricity higher than China’s.

Natural gas first emerged as a power generation fuel to replace dirtier coal. Lately, gas has cemented its reputation as the dominant source of reliable electricity in the U.S. as demand soars—and investors are loving it.

“Natural gas-fired generation is becoming more attractive to investors because of its critical role in balancing the grid amid increased load growth expectations, accelerated coal retirements and higher levels of intermittent generation,” Enverus analyst Corianna Mah said in comments on the release of a new report looking into the role of natural gas in the U.S. grid security and reliability.

Indeed the push to shift from hydrocarbons to alternative sources of energy and make the economy a lot more reliant on electricity than liquid fuels has really made natural gas stand out. When it became the dominant power source in the U.S. energy mix, that was the result of abundant supply thanks to the shale boom and the fact that gas burns more cleanly than coal.

To date, despite the substantial growth in wind and solar, gas remains the dominant energy source, providing 43% of U.S. electricity, with wind, solar, and hydro all together a distant second, providing 21.4% of the country’s electricity. And only gas can ensure electricity is there on-demand.

This advantage of gas, coal, and nuclear has regained its well-deserved prominence recently as Big Tech rushed to secure electricity supply for the data centers it needs for its artificial intelligence products. Wind and solar were all very well and very clean, but they were unable to provide the kind of round-the-clock steady power supply these data centers needed. So Big Tech turned to gas and nuclear.

“Never have I seen such strong prospects for North American natural gas demand growth,” TC Energy’s chief executive, François Poirier, said in August. “We are seeing natural gas demand reach record highs, and this is expected to grow by nearly 40 Bcf/d by 2035.”

Indeed, power generation data from climate outlet Ember showed that natural gas has pushed the United States’ overall dependence on hydrocarbons for electricity higher than China’s. Since June 2024, high U.S. summer electricity demand has been mostly met by increased gas-fired power generation, while a rebound in hydropower in China has limited to some extent the share of coal in its electricity supply.

As a result, hydrocarbons – including natural gas and coal – have had an average share of 62.4% of total electricity output in the United States since June. This compares to a lower fossil fuel share in the coal-dominated power system in China, where fossil fuels accounted for 60.5% of generation between June and September.

This state of affairs is unlikely to change. Earlier this week, the chief executive of BP Murray Auchincloss said that the AI race among Big Tech majors would drive natural gas demand in the U.S. even higher.

“Hyperscalers are driving crazy demand into natural gas right now,” Auchincloss said at an investor presentation, as quoted by Bloomberg. “I’m pretty optimistic on natural gas prices through the decade.”

Indeed, Auchincloss is not the only one optimistic on natural gas prices. Most industry executives are also optimistic thanks to the surge in demand driven by the tech industry—and population growth, which caught power utilities unaware earlier this year after everyone assumed demand growth had peaked in the 2010s, because that growth was followed by an extended plateau.

However, “burgeoning data-centre development, a resurgence in energy-intensive US manufacturing, and greater transport and heating electrification” have promoted “electricity demand growth not seen since the 1990s,” Wood Mackenzie analysts wrote in a recent report looking into demand and the supply outlook.

Speaking of supply, it might get tight, even in natural gas. U.S. power generation from natural gas surged by 20% in the first nine months of this year compared to the same period in 2019. The share of gas in power supply has jumped to 43% from 38% five years ago. There are plans to add new gas-fired generation capacity to meet the rising demand. Yet it takes years to bring these new power plants on, meaning the near future may very well hold an electricity market demand imbalance and higher prices.

Natural gas production, meanwhile, is on a downward trajectory, driven by persistently low market prices for the commodity. The situation may seem paradoxical, but let’s remember that much of the booming demand for electricity is projected rather than current, and it would take some time before the surge materializes—which would hinge on new generation capacity being added to the grid.

However long it takes, one thing seems clear, regardless of how anyone in government or transition circles feels about it. Natural gas provides a reliable electricity supply independent of weather patterns and the Earth’s revolutions around the Sun. Big Tech and its AI drive just reminded everyone about it. (1)

The following press release from Enverus is interesting. Not only does it make the case that natural gas is where investors should be putting their money with respect to power generation, it also identifies the areas where they believe building gas-fired power plants makes the most sense (given the overall economics and availability of natgas).

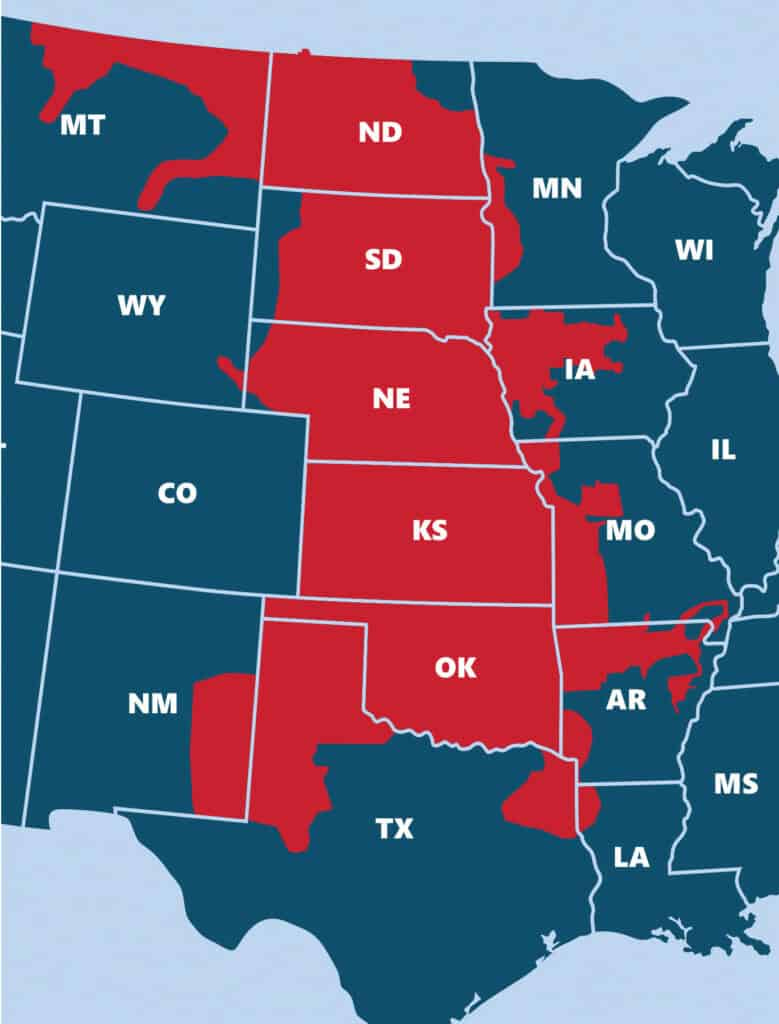

Unfortunately, we only have the press release overview and not the full report. The overview shows the top place to build new gas-fired plants is the SPP grid, otherwise known as the Southwest Power Pool, a hefty chunk of states in the middle of the country from Oklahoma and parts of Texas in the south to North Dakota and Montana in the north:

The report also identifies WECC and ERCOT as good places to build gas-fired power plants. WECC is the Western Electricity Coordinating Council, a collective of grids in the western third of the country. ERCOT is the Electric Reliability Council of Texas, the grid that serves most of the great (free) state of Texas.

As far as we can tell, PJM isn’t mentioned in the report, but with data centers popping up in the Southeastern U.S., we think PJM is a great place to build a new gas-fired plant.

At any rate, here’s an overview of the new Enverus report touting natural gas as THE premier choice for grid stability:

Enverus Intelligence® Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS company that leverages generative AI across its solutions, has released a new report looking at natural gas-fired generation, which is becoming more attractive to investors because of its critical role in balancing the grid amid increased load growth expectations, accelerated coal retirements and higher levels of intermittent generation.

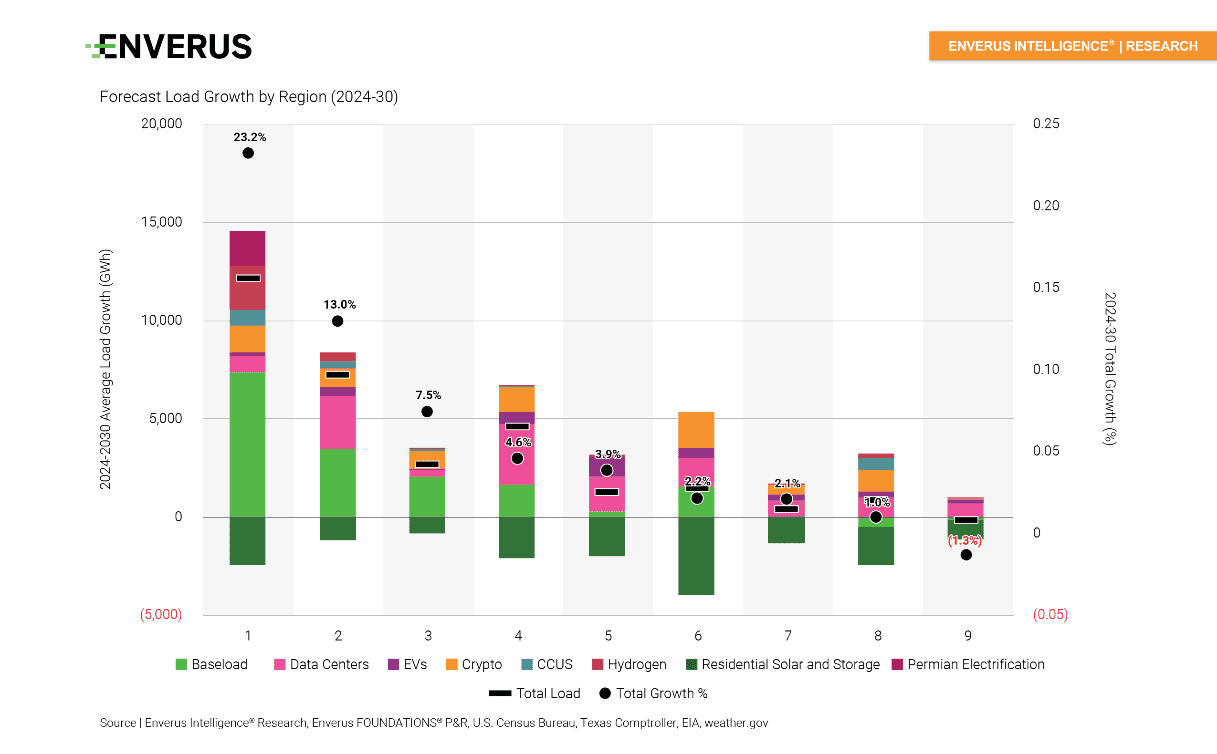

This report builds on EIR’s previous solar, battery storage and onshore wind market screening analyses to identify top regions for natural gas power plants in the U.S. Taking into account factors like forward power prices, gas feedstock costs, power demand growth, evolution of the generation mix and relative cost of entry via acquisition, SPP screens as the premier market.

“Natural gas-fired generation is becoming more attractive to investors because of its critical role in balancing the grid amid increased load growth expectations, accelerated coal retirements and higher levels of intermittent generation,” said EIR analyst Corianna Mah.

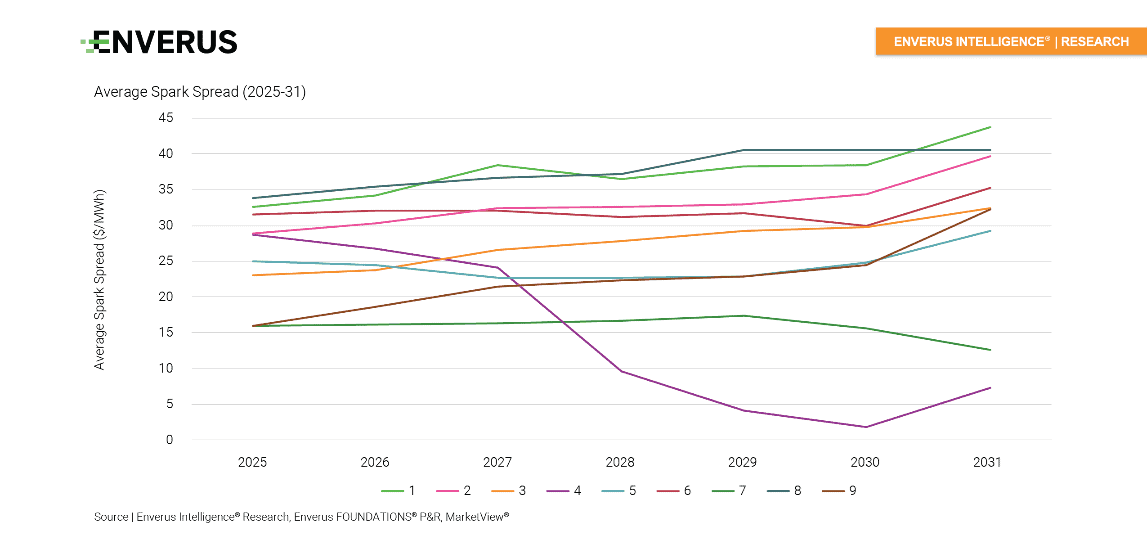

“We find SPP stands out as the premier market for natural gas generation, driven by factors such as robust forward power prices, low gas feedstock costs, the absence of carbon pricing and higher expected price volatility. Conversely, NYISO, CAISO and ISONE are the least attractive due to high feedstock costs, low spark spreads, lower expected power price volatility, weaker demand growth and higher carbon prices,” added Mah.

“Our top three markets — SPP, WECC and ERCOT — score high marks for expected load expansion because of power-hungry data centers, cryptocurrency mining, and oil and gas electrification in their territories. ERCOT and SPP also benefit from lower feedstock costs thanks to natural gas production in their regions, while WECC’s forward power price curve is strong enough to offset its higher gas costs,” Mah said.

Key takeaways from the report:

SPP screens as the premier Tier 1 market for natural gas generation due to its attractive forward power prices, low gas feedstock costs, lack of carbon pricing, higher expected price volatility and relatively low acquisition cost of entry.

NYISO, CAISO and ISONE rank as the least-attractive markets, or Tier 4, due to high gas feedstock costs, low spark spreads, lower expected power price volatility, relatively weak demand growth, high carbon prices and high acquisition cost of entry.

Forecast load growth is the most important factor in EIR’s market assessment. Increased demand amplifies the need for reliable and dispatchable resources like natural gas plants that will play a crucial role in backstopping intermittent renewables.

Spark spreads are another key factor in EIR’s analysis, with the top three markets ranking highly based on current forward price curves. Forward power prices in these markets are likely elevated due to expected load growth. (2)

(1) OilPrice.com/Irina Slav (Oct 30, 2024) – Gas Reigns Supreme in U.S. Grid

(2) Enverus (Oct 23, 2024) – Natural gas emerges as premier choice for grid stability amid rising demand and coal retirements